Certificate of Deposit and IRA Rates

| Term | Minimum Balance to Earn APY |

Interest Rate | APY |

| 91 Day C.D. | $1,000 | 0.100% | 0.100% |

| 182 Day C.D. | $1,000 | 3.950% | 3.990% |

| 12 Month C.D. | $500 | 3.900% | 3.960% |

| 18 Month C.D. | $500 | 3.800% | 3.870% |

| 24 Month C.D. | $500 | 3.750% | 3.800% |

| 27 Month C.D. | $500 | 2.000% | 2.020% |

| 30 Month C.D. | $500 | 2.000% | 2.020% |

| 36 Month C.D. | $500 | 3.750% | 3.800% |

| 48 Month C.D. | $500 | 0.400% | 0.400% |

| 60 Month C.D. | $500 | 2.000% | 2.020% |

__________________________________________________________________________________________________

A Huntington Federal banker will be happy to help you explore the best CD or IRA option for your personal needs.

Call or Click to Get in Touch:

304-528-6200 | Contact Us

__________________________________________________________________________________________________

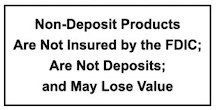

Rates and Annual Percentage Yields effective as of 4/08/2025. Minimum balance (the amount of principal in the account each day) to open and earn APY is $500. Account fees may affect earnings. The above-described savings programs are all variable rate accounts on which the interest rate offered on new certificates of deposit may change at any time; however, when purchased the certificate deposit rate will be guaranteed for the term of the particular certificate program purchased. Ask for further information about our types of accounts and their rates. Daily Balance (The amount of principal in the account at the end of each day). Subject to penalty for early withdrawal. If purchasing a Certificate of Deposit as an IRA, please consult your tax professional for specific guidelines for IRA deduction and contribution limits. The FDIC, an agency of the U.S. Government, insures all depositor’s savings up to $250,000 in accordance with the rules and regulations of the FDIC.